rhode island income tax rate 2021

These rates are subject to change. Calculations are estimates based on tax rates as of Dec.

Welcome Ri Division Of Taxation

The Division of Taxation has posted the income tax rate schedule for 20 22 that will be used by fiduciaries for many trusts and estates.

. Rhode Island Income Tax Calculator 2021. Your average tax rate is 1198 and your. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated.

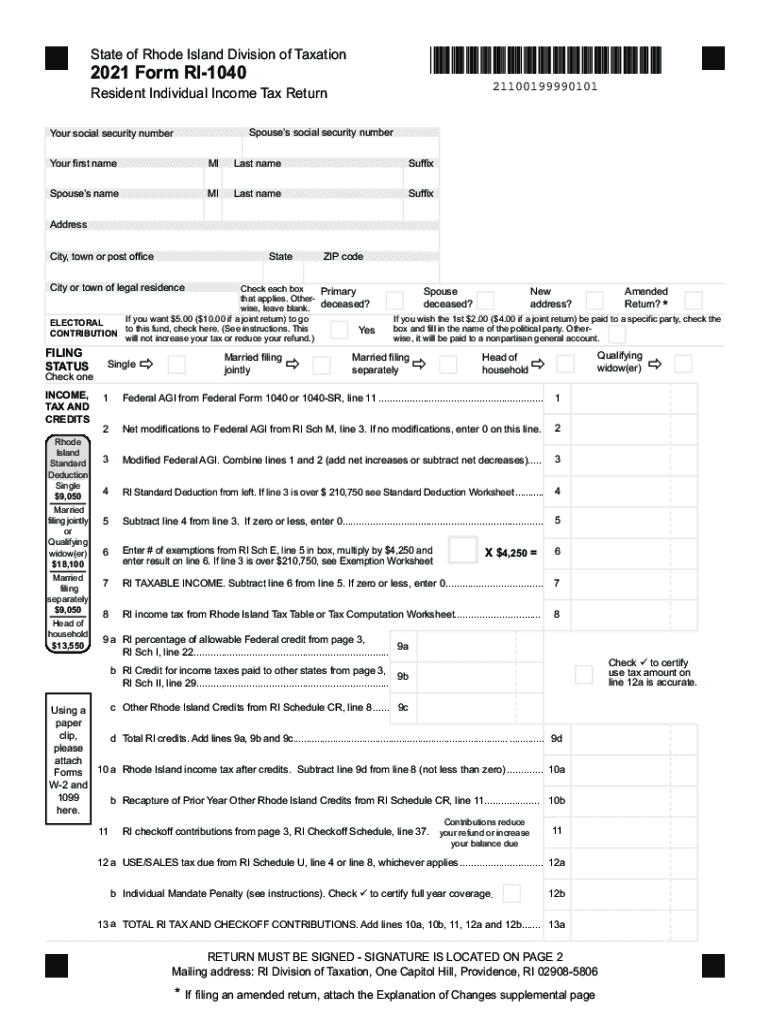

Detailed Rhode Island state income tax rates and brackets are available on. DO NOT use to. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

DO NOT use to. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Outlook for the 2023 Rhode Island income tax rate is to remain unchanged with income tax brackets increasing due to the annual inflation adjustment.

Our income tax and. Our income tax and paycheck calculator can help you understand your take home pay. If you make 140000 a year living in the region of Rhode Island USA you will be taxed 32198.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Income tax rate schedule.

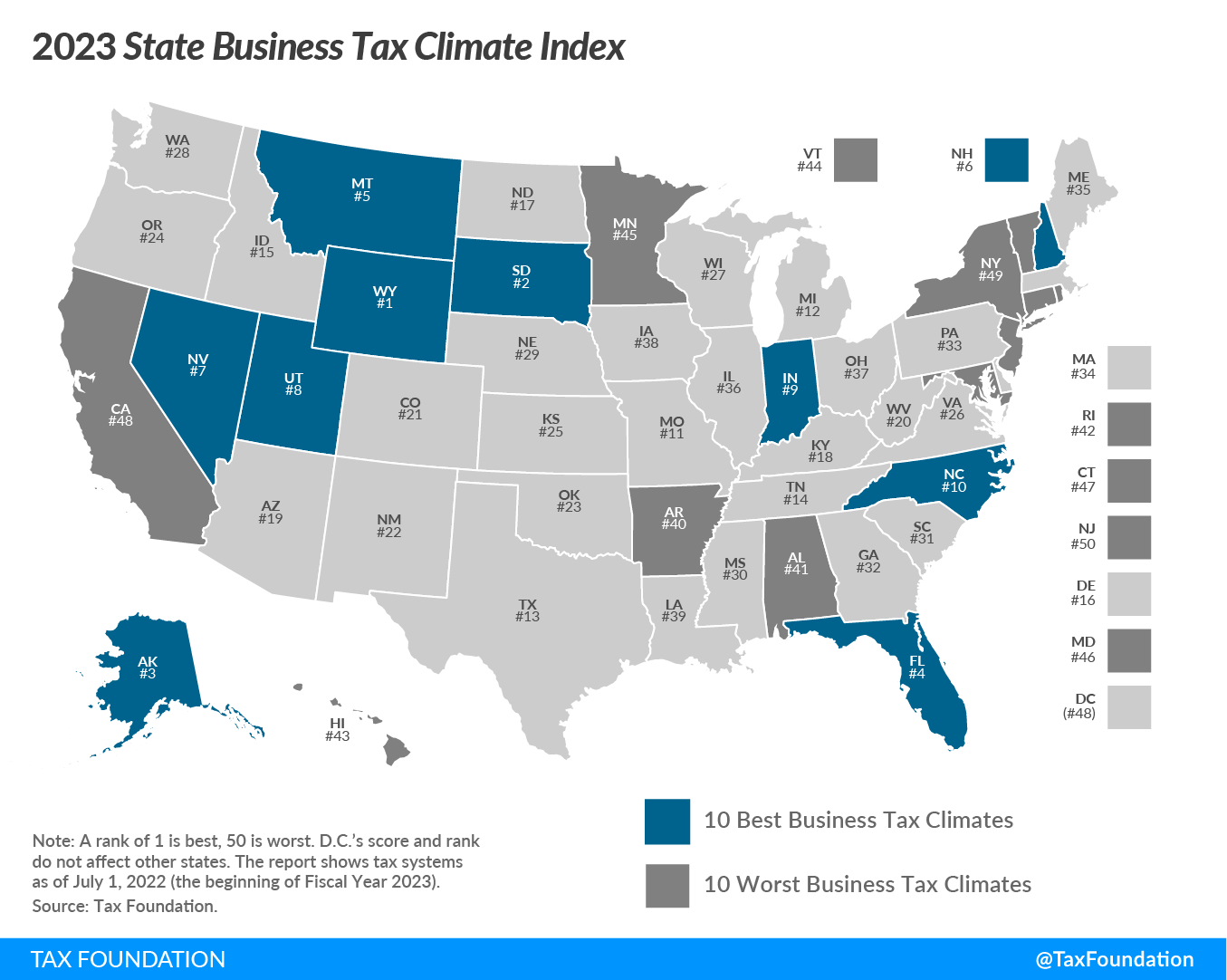

Income Tax Sales Tax Fuel Tax Property Tax. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the. 2021 and data from the Tax Foundation.

If you make 209000 in Rhode Island what will your salary after tax be. The table below shows the income tax rates in Rhode Island for all filing statuses. RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION.

RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. If youre married filing taxes jointly theres a tax rate of 375.

Your average tax rate is 1758 and your. The Rhode Island State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Rhode Island State Tax Calculator. Rhode Island Tax Brackets for Tax Year 2021.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Any income over 150550 would be. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

Total Estimated 2021 Tax Burden. Rhode Island Income Tax Calculator 2021. Rhode Island Income Tax Calculator 2021.

Detailed Rhode Island state income tax rates and brackets are available on. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. Rhode Island Income Tax Calculator 2021.

These rates are subject to change. Detailed Rhode Island state income tax rates and brackets are available on. In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single or married filing taxes separately.

2021 and data from the Tax Foundation. Calculations are estimates based on tax rates as of Dec. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by.

Revenue For Ri Kicks Off Campaign To Tax The One Percent

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

State Income Tax Rates Highest Lowest 2021 Changes

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Rhode Island Income Tax Brackets 2020

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

17 States With Estate Taxes Or Inheritance Taxes

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

States With The Highest Lowest Tax Rates

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

2022 Capital Gains Tax Rates By State Smartasset

Top States For Business 2022 Rhode Island

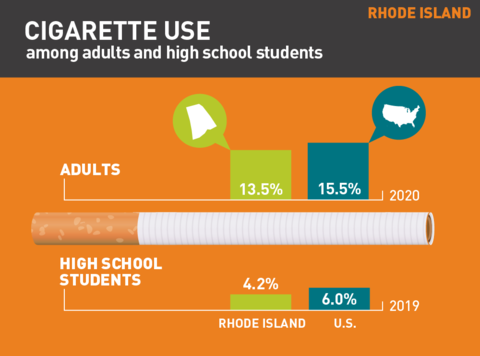

Tobacco Use In Rhode Island 2021

Consumer Alert Rhode Islanders Could Owe State Taxes On Unemployment Wjar

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

2021 Form Ri Dot Ri 1040x Nr Fill Online Printable Fillable Blank Pdffiller